Mass State Income Tax Rate 2025. Up to £2,880 per year can be invested, topped up to £3,600 with 20 per. To calculate how much tax you owe, first calculate your massachusetts gross income.

Massachusetts has a progressive state income tax system that ranges from 5% to 9%. For tax year 2025 (taxes filed in 2025), massachusetts’ state income tax rate was 5% on annual gross income over $8,000.

As a taxpayer, you must make quarterly estimated tax payments if the expected tax due on your taxable income not subject to withholding is more than $400.

T200018 Baseline Distribution of and Federal Taxes, All Tax, Welcome to the money blog, your place for personal finance and consumer news and tips. The highest tax rate would be 30.

Understanding Massachusetts State Tax Rates A Comprehensive Guide for, January 2025 showed another shortfall in tax revenue, this time just over $260 million, triggering concerns on both sides of the state house. Massachusetts gross income is federal gross income:.

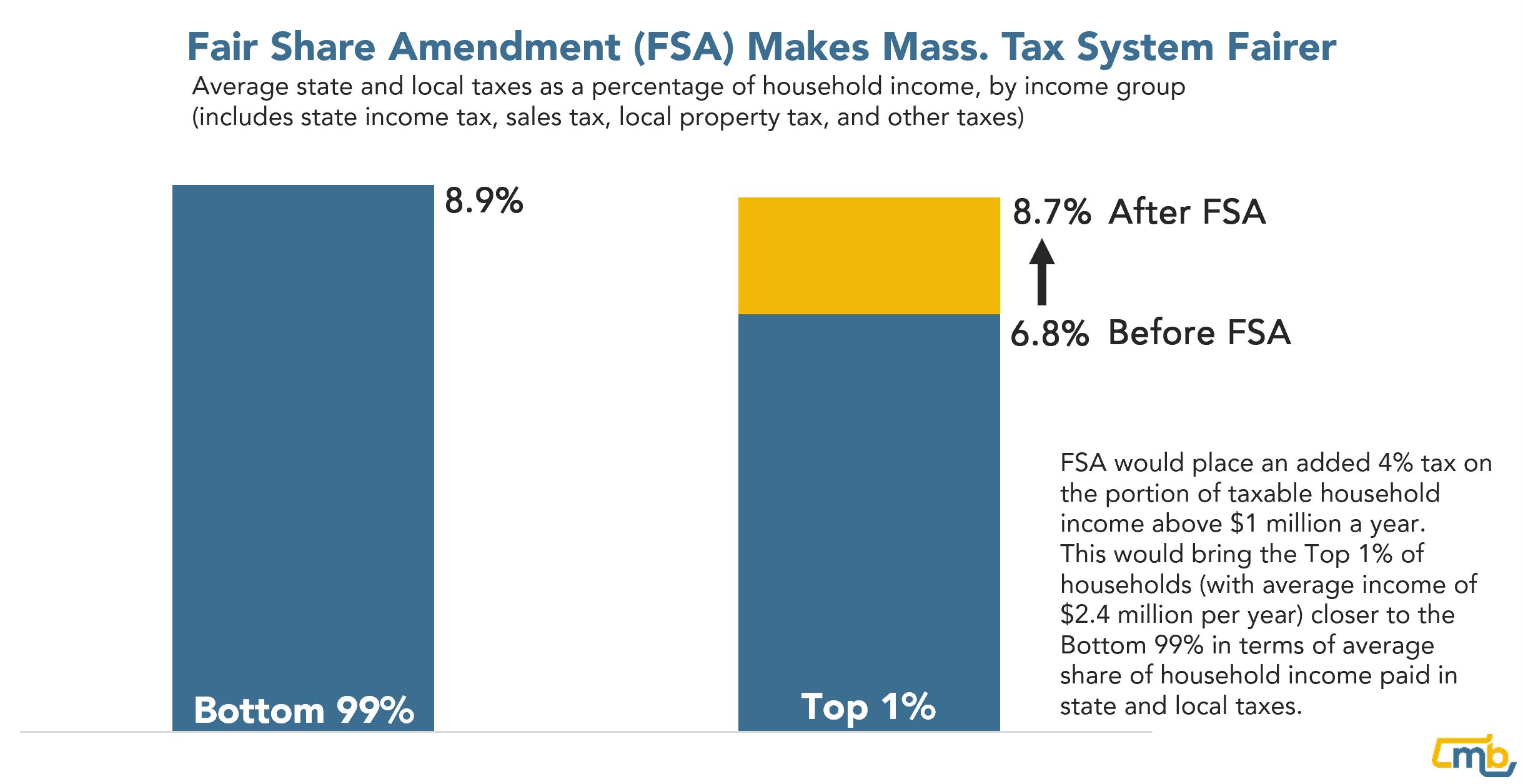

“Millionaire Tax” Would Make Massachusetts Tax System Fairer Mass, Welcome to the money blog, your place for personal finance and consumer news and tips. With those headwinds in mind,.

Mass State Tax Rate 2025 Anny, Calculate your annual salary after tax using the online massachusetts tax calculator, updated with the 2025 income tax rates in massachusetts. Massachusetts has an 8 percent corporate income tax rate.

美国各州企业所得税、个人所得税和消费税税率对比_卓盈企业管理有限公司, For due dates, go to dor tax due dates and extensions. For tax year 2025 (taxes filed in 2025), massachusetts’ state income tax rate was 5% on annual gross income over $8,000.

massachusetts estate tax rates table Boisterous EJournal Stills Gallery, 5.00% flat rate, 4% surtax on income over $1 million; To calculate how much tax you owe, first calculate your massachusetts gross income.

Massachusetts Estate Tax Rates Table Estate Tax Current Law 2026, While the state levies a. The massachusetts tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in massachusetts, the calculator allows you to calculate.

Massachusetts Millionaires Tax Massachusetts Graduated Tax, While taxes are an essential source of revenue for all state governments, the manner in which they are imposed varies widely from state to state. Are you considering moving or earning income in another state?

Tax Rates 2025 2025 Image to u, Massachusetts has a progressive state income tax system that ranges from 5% to 9%. Income tax withholding tables at 5.0% effective january 1, 2025.

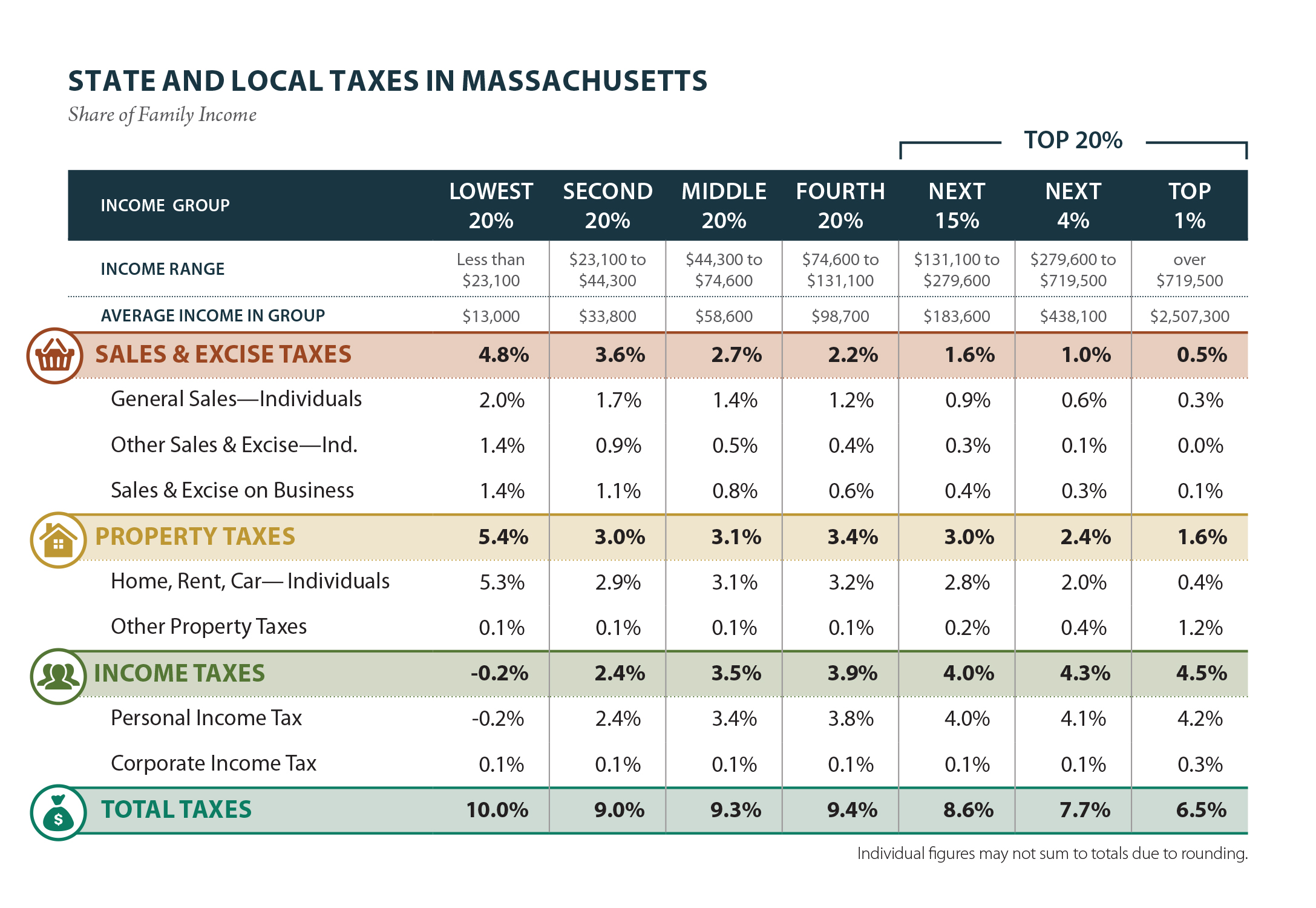

Massachusetts Who Pays? 6th Edition ITEP, While the state levies a. Massachusetts has an 8 percent corporate income tax rate.

You can quickly estimate your massachusetts state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to.