Did Tax Deductions Change For 2025. Income tax thresholds were increased by 1 per cent in 2025 and 2.4 per cent in 2025. See the tax rates for the 2025 tax year.

However, the income thresholds for all tax brackets. Features tax changes and key amounts for the 2025 tax year.

Your Home Tax Deduction Checklist Did You Get Them All? Tax, For the 2025 tax year, for example, the 24 percent tax bracket kicks in on income over $95,375 for single taxpayers and $190,751 for married joint filers, with similar changes. The irs in november unveiled the federal.

Lets Talk Tax Deductions! Shellharbour Marina Real Estate, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. A handful of tax provisions, including the standard deduction and tax brackets, will see.

“New and Improved” Tax Deductions for Parents of Children with Special, The tax cuts and jobs act, commonly known as the “trump tax cuts,” became effective in the 2018 tax year. Features tax changes and key amounts for the 2025 tax year.

15 Tax Deductions for Small Businesses in 2025, For tax year 2025, each of the seven rates will apply to the following new income tax brackets: Many of its alterations are set to expire after 2025.

Tax Deductions List, Business Tax Deductions, Bookkeeping Business, Tax, Many of its alterations are set to expire after 2025. The irs has rolled out a series of tax code changes for 2025, reflecting adjustments in response to inflation and other economic factors.

Tax & Deductions Armstrong Economics, Tax deductions for the 2025 tax year the standard deduction for married couples filing jointly for tax year 2025 rises to $29,200, an increase of $1,500 from tax. The internal revenue service unveiled a new online tax filing system this year that allowed more than 140,000 people to file their federal taxes for free.

LesserKnown Tax Deductions Taurus CPA Solutions, The limitation on itemized deductions, also eliminated by the tax cuts and jobs act, continues to have no effect for 2025, maintaining the status from 2018 onwards. Tax deductions, tax credit amounts, and some tax laws have changed for the 2025 tax filing season.

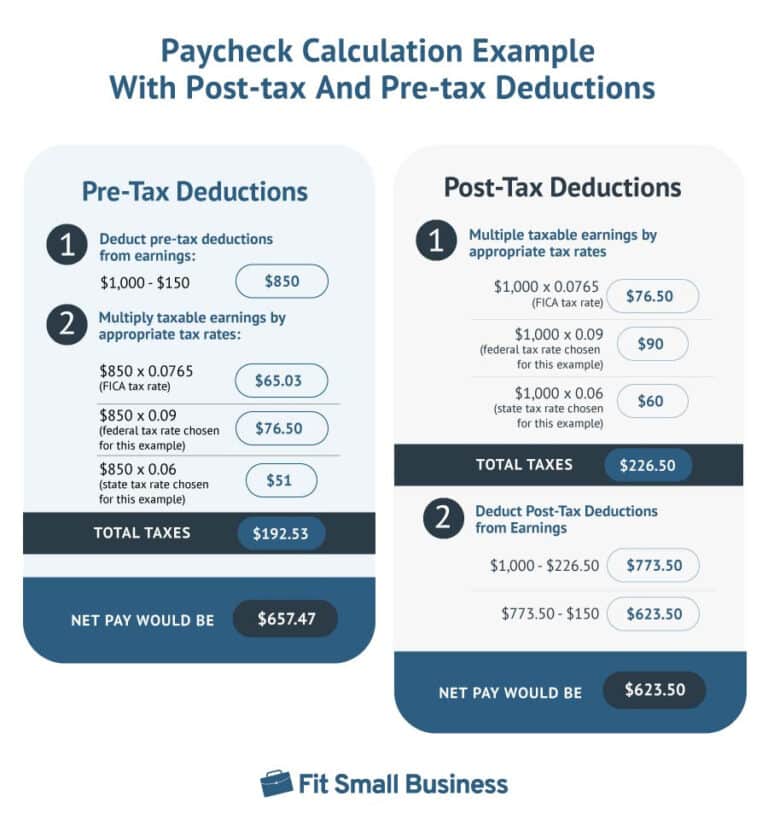

Pretax Deductions & Posttax Deductions An Ultimate Guide, And for heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of. There are lots of tax changes for 2025.

Tax Deductions for Short Term Rental Properties My Online Accountant, And for heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of. 4, 2025 — tax credits and deductions change the amount of a person’s tax bill or refund.

What Happens if You File Taxes Late? Story Wealthy Nickel, 4, 2025 — tax credits and deductions change the amount of a person’s tax bill or refund. The irs did not change the federal tax brackets for 2025.

The tax cuts and jobs act, commonly known as the “trump tax cuts,” became effective in the 2018 tax year.

The limitation on itemized deductions, also eliminated by the tax cuts and jobs act, continues to have no effect for 2025, maintaining the status from 2018 onwards.